Financial Remedies in Divorce – A Guide to Settlements in England & Wales

Divorce often brings financial uncertainty, making it important for separating couples to understand how assets and income will be divided. In England and Wales, the courts aim for fairness, but this doesn’t always mean a 50/50 split. Financial remedies – also known as financial settlements – help ensure a fair outcome for both parties, taking into account their unique circumstances.

At Mediate UK, we guide couples through financial settlements, helping them reach amicable agreements without unnecessary court battles. Below, we break down how financial remedies work, key legal principles, and important case law that may impact your settlement.

What Are Financial Remedies?

Financial remedies refer to court orders or negotiated agreements that determine how assets, property, pensions, and ongoing financial support are handled after a divorce. These may include:

- Lump sum payments – One spouse may be required to pay a fixed amount to the other.

- Property adjustment orders – Determining who retains or sells the family home.

- Spousal maintenance – Ongoing payments from one spouse to another.

- Pension sharing orders – Splitting pension funds between spouses.

- Child maintenance – Separate from financial remedies, but a key factor in post-divorce finances.

How Are Financial Settlements Decided?

When deciding financial remedies, the court follows Section 25 of the Matrimonial Causes Act 1973, considering several factors:

- Income and Earning Capacity – What each party earns and their future financial potential.

- Financial Needs and Responsibilities – The standard of living during the marriage and ongoing financial needs.

- Age and Duration of Marriage – Long marriages often lead to more equal division, while shorter marriages may not.

- Contributions to the Marriage – Financial contributions, homemaking, and childcare are all considered.

- Standard of Living – Courts aim to maintain a similar standard of living where possible.

- Disabilities and Health Conditions – If one spouse has long-term health needs, this can affect the settlement.

- Conduct (Rarely Considered) – Unless conduct is “gross and obvious,” such as fraud or financial misconduct, it typically doesn’t affect the outcome.

Courts prioritise fairness over equal division, meaning settlements depend on individual circumstances rather than a rigid formula.

GET IN TOUCH TO FIND OUT HOW MEDIATE UK CAN HELP WITH YOUR PARENTING OR FINANCIAL DISPUTE, OR WITH A DIVORCE OR SEPARATION.

CALL 0330 999 0959 OR CLICK HERE FOR A FREE 15-MINUTE CONSULTATION

Key Legal Principles and Landmark Cases

Over the years, case law has shaped how financial remedies are handled. Here are some of the most significant rulings:

Equal Sharing vs. Needs-Based Settlements

- White v White (2000) – This landmark case established that courts should start with the presumption of equality, ensuring that neither spouse is unfairly disadvantaged.

- Miller v Miller & McFarlane v McFarlane (2006) – Introduced the principle of compensation, recognising that one spouse may have sacrificed their career for the marriage.

Short Marriages and Unequal Division

- Sharp v Sharp (2017) – Courts may depart from equal division in short, childless marriages where finances were kept separate.

Spousal Maintenance: How Long Should It Last?

- Wright v Wright (2015) – Maintenance should not be indefinite; recipients are expected to seek financial independence where possible.

- SS v NS (2014) – Courts assess whether ongoing maintenance is needed or whether a clean break is more appropriate.

Business and Pre-Marital Assets

- Jones v Jones (2011) – Clarified how to value a business acquired before marriage, ensuring only the growth during marriage is considered.

- XW v XH (2019) – Addressed whether one spouse’s business success qualifies as a “special contribution”, potentially justifying a larger share.

Pensions and Financial Offsetting

- A v R (2021) & W v H (2021) – Defined how pension offsetting should work when dividing retirement funds.

Delayed Financial Claims

- Wyatt v Vince (2015) – Reinforced that ex-spouses can claim financial relief decades after divorce if no clean break order was issued.

How Mediate UK Can Help

At Mediate UK, we specialise in helping couples reach financial settlements outside of court, reducing stress, legal costs, and delays. Our family mediators can assist with:

At Mediate UK, we specialise in helping couples reach financial settlements outside of court, reducing stress, legal costs, and delays. Our family mediators can assist with:

- Identifying fair asset division based on legal principles.

- Helping couples understand their financial rights.

- Encouraging amicable negotiations to avoid lengthy court battles.

- Facilitating discussions on spousal and child maintenance.

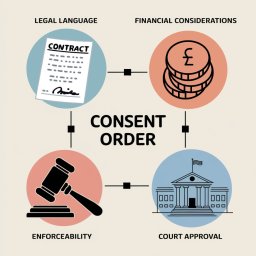

We offer a fixed-fee financial family mediation service and can also arrange for a solicitor to draft a legally binding consent order.

Book a Free Consultation

If you need guidance on financial remedies in divorce, book a free 15-minute consultation with one of our friendly case managers or simply call us on 0330 999 0959.

For more information, check out our Ultimate Guide Financial Settlement on Divorce.